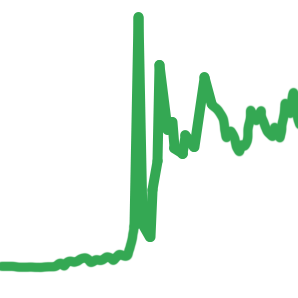

On January 27, 2021, according to historical trading data, the trading price of GME reached an all time high of $380 pre-split or $95 post-split.

On this day, DFV posted an update of his GME holdings valued at approximately 48 million dollars.

It was this relatively extreme trading price that attracted an enormous amount of attention on social media and in mainstream media, and was the peak of the GME sneeze.

Although Wikipedia is one of the most neutral sources of information that exists, this event is referred to there as the “GameStop short squeeze”. It is the view of many GameStop investors that this is a misnomer, that it wasn’t actually a short squeeze. Did short hedge funds close their short positions? If they didn’t, then it wasn’t really a short squeeze was it?

It wasn’t until the next day, on January 28 when numerous stock brokers (in conjunction, and at the direction of who?) disabled the ability of customers to buy more shares of GME.

Since this peak, there has been a great deal of attention and many different narratives created about the GameStop saga. Certain parties out there would have you believe that this peak was just a flash in the pan, and that you should probably forget GameStop. But GameStop investors here and elsewhere know that the saga is far from over.